Market Wrap: Crypto Sentiment Improves, Though Risk Remains as Russia Plays Down Peace Talks

Don't miss CoinDesk's Consensus 2022, the must-attend crypto & blockchain festival experience of the year in Austin, TX this June 9-12.

Bitcoin (BTC) traded in a tight range between $46,000 and $47,000 during the New York trading day as geopolitical risk kept some buyers on the sidelines.

On Wednesday, Russian diplomats stated that peace talks with Ukraine haven't reached a turning point. Meanwhile, fighting intensified between the two nations, which contributed to an uptick in oil and gold prices.

Sign up for Market Wrap, our daily newsletter explaining what happened today in crypto markets – and why. Coming April 4.

Still, most alternative cryptocurrencies (altcoins) outperformed bitcoin on Wednesday, which suggests traders are still comfortable with additional risk. For example, AAVE and Solana's SOL token rose by as much as 7% over the past 24 hours, compared with a 1% gain in bitcoin over the same period.

Latest prices

●Bitcoin (BTC): $47,107, −1.32%

●Ether (ETH): $3,399, −1.01%

●S&P 500 daily close: $4,602, −0.63%

●Gold: $1,940 per troy ounce, +1.47%

●Ten-year Treasury yield daily close: 2.36%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Sentiment improves

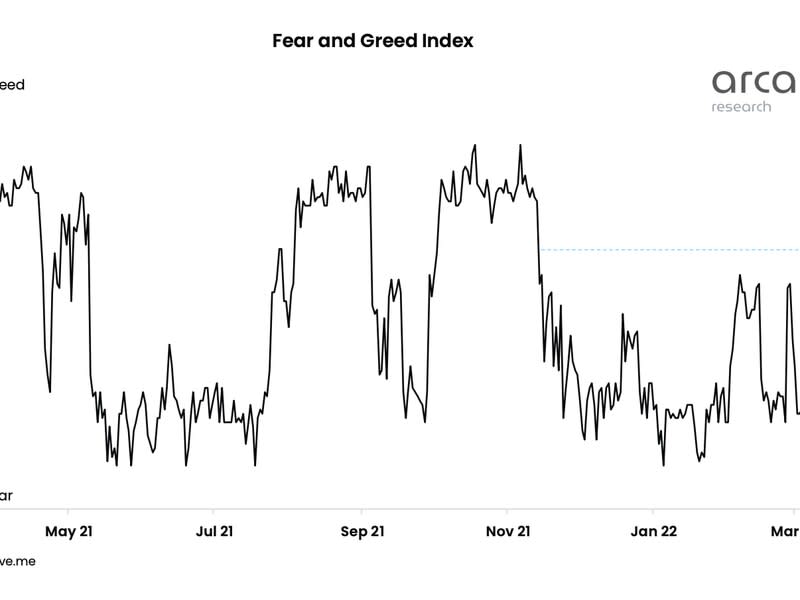

The bitcoin Fear & Greed Index entered "greed" territory, which indicates bullish sentiment among crypto traders.

The index is at its highest level this year, but is still below peak levels of "extreme greed" seen last November. That suggests further room for investor sentiment to improve, especially if BTC's price recovery is sustained.

Over the past few months, however, sentiment readings have been erratic as BTC declined by as much as 50% and then stabilized in a trading range, albeit with 20% price swings. It is very difficult to get a clear reading on crypto sentiment, especially during times of market stress.

"Market participants should keep in mind that every time we have shown the slightest sign of greed this spring, the market has slammed us back into a fearful state," Arcane Research wrote in a report.

Bitcoin dominance fades

Bitcoin's market capitalization relative to the total crypto market cap, or the "dominance ratio," dipped below its 50-day moving average, which means altcoins are starting to outperform.

Typically, a declining bitcoin dominance ratio indicates a greater appetite for risk among crypto investors. In contrast, a rising dominance ratio signals a flight to safety as investors reduce their exposure to altcoins, which have a greater risk profile than bitcoin.

For now, the dominance ratio is stabilizing after a sharp decline last year. A base of around 40% is seen in the chart below, which is above the previous low of 35% reached in 2018.

Altcoin roundup

Aave’s token rockets 97% since upgrade strengthened DeFi capabilities: Aave’s native token has surged nearly 97% since the protocol's version 3 (v3) upgrade earlier this month. Aave rose almost 33% on Tuesday as demand for its tokens increased among traders. Open interest on AAVE-tracked futures – or the total number of contracts held by market participants – hovers at $210 million, while DeFi (decentralized finance) trackers show value locked on Aave increased 10% in the past week to $14 billion. Read more here.

Filecoin’s storage deals: While decentralized storage is still in its early days, the Filecoin ecosystem has been expanding over the years. Various use cases have emerged, including non-fungible tokens (NFTs), Web 3, gaming, metaverse and audio/video. Users pay Filecoin fees to store data, and the prices are determined by supply and demand. To incentivize storage providers to participate, Filecoin rewards them with the network's native token (FIL). Read more from Messari here.

Women-led DAO tackles lack of gender diversity in crypto: H.E.R. DAO is a woman-led decentralized autonomous organization that is focusing on increasing gender diversity in the blockchain industry. The group has sponsored "Hacker Houses" for women developers across the world. Read more here.

Relevant reads

EU's MiCA Bill to Enter Next Phase of Negotiations on Thursday: The landmark Markets in Crypto Assets legislative framework will now be discussed between the European Parliament, Council and Commission.

ECB Official Calls for ‘Less Tolerant’ Approach to Bitcoin ‘Gambling’: Fabio Panetta's remarks come as EU lawmakers consider measures to end anonymous crypto transactions and cut off unregulated exchanges.

Sky Mavis Pledges to Reimburse Players Following Axie Infinity Hack: The company behind the popular play-to-earn game made the promise after a $625 million hack.

Small Digital Euro Payments Won’t Need Laundering Checks, ECB Official Says: The proposals regarding the potential future central bank digital currency come as lawmakers prepare to scrap anonymous bitcoin payments.

Binance Suspends Deposits and Withdrawals on Ronin Network After Hack: Gaming-focused Ronin on Tuesday disclosed a loss of more than $625 million in USDC and ether.

Other markets

Digital assets in the CoinDesk 20 ended the day higher.

Largest winners:

Asset | Ticker | Returns | Sector |

|---|---|---|---|

Solana | +6.4% | ||

EOS | +2.6% | ||

Litecoin | +1.9% |

Largest losers:

Asset | Ticker | Returns | Sector |

|---|---|---|---|

Filecoin | −4.2% | ||

Internet Computer | −1.9% | ||

Dogecoin | −1.5% |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.